Community Foundation Sonoma County’s Investment Advisory Committee developed a new investment strategy for the Long-Term Pool. The changes went into effect at the end of June 2015.

The goal of the changes is to improve transparency and communication, eliminate the portfolio tracking error, and reduce investment costs.

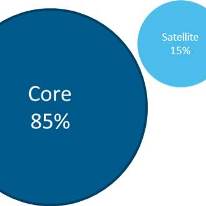

The strategy moves the Long-Term Pool to a Core-Satellite investment model. The core of the portfolio (85%) will consist of passive investments that track major market indices with minimal tracking error. Additional positions, known as satellites (15%), are added to the portfolio in the form of active or passive investments that allow for greater flexibility.

The core will have a home country bias, and value bias. It will be market capitalization neutral and contain a strategic allocation with disciplined rebalancing back to targets. All core investments will be passive.

The satellite will have a shorter time horizon, emphasize diversification. It will seek excess returns above the core portfolio over full market cycles. The Investment Advisory Committee will select managers who invest in both active and passive vehicles in each of the identified sub-asset classes.

The Investment Advisory Committee will now shift their attention to assessing the Intermediate-Term Pool, Short-term Pool and Socially Responsible Pool.

For more information, please contact J Mullineaux, Vice President for Philanthropic Planning.